Are you looking for a property? You are getting ready to make your first real estate investment and are looking for information and advice on the steps and procedures to follow to complete this major project.

Our team of real estate brokers has prepared a summary document, inspired by the OACIQ Buyer’s Guide, which outlines the main steps to follow in order to carry out your project in complete confidence.

Here is a summary of the main topics covered in this buyer’s guide.

BEFORE: The search for the perfect property

The first important step is to establish your budget. Indeed, it is important that it takes into account your lifestyle, your daily expenses, your payments, your debts, while taking into account your medium and long term objectives.

This way, you will know exactly what budget you can allocate to the purchase of a property, in addition to directing your search in the right direction, towards homes that respect your budget limit.

Mortgage pre-approval

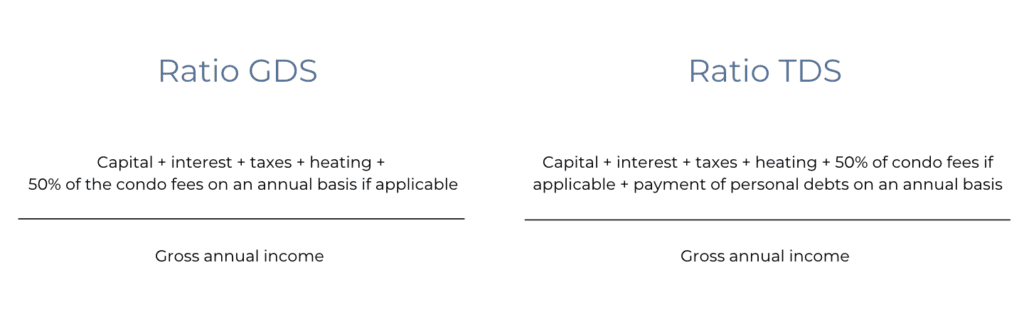

It will then be important to have a mortgage pre-approval that assesses your ability to borrow from the bank. This document will be given to you by a mortgage broker, who will probably use one of the following two ratios :

Down payment

You will then need to determine the amount of your down payment, which is the amount you will have to pay when you purchase the property. This amount will then be deducted from the purchase price of the property. This amount will depend on the type of property you are purchasing (divided co-ownership, undivided, income property, etc.).

Additional fees

As a real estate buyer, you should also set aside a preventive amount to cover the inspection, notary fees, transfer duties and all other expenses related to the acquisition of a property, as well as any unforeseen circumstances that may arise.

HBP – Home Buyers' Plan

Also note that if this is your first real estate purchase, the HBP (Home Buyer’s Plan) may be of interest to you! Consult our guide to find out more about it.

Research criteria

Also, be sure to define your search criteria, the geographic area you are looking for, the type of neighborhood you want to live in, your needs, restrictions, etc. A detailed sheet in our buyer’s guide will help you narrow down your search criteria.

Contact one of our real estate brokers to help you establish your criteria.

DURING

If you wish to do business with a professional in the sector, discover our real estate brokers in Montreal who will be pleased to accompany you in your steps. Real estate professionals are protected by the Real Estate Brokerage Act, which, as mentioned by the OACIQ, will help protect you during your transaction.

In addition, real estate brokers generally have a network of contacts that will allow you to surround yourself with the best experts in each of the fields necessary for a successful transaction: mortgage broker, notary, inspector and others.

The Seller's Declaration

The Seller’s Declaration is the document in which the seller records all the information he or she is aware of about his or her property that may help future buyers make up their minds about the property, including any defects or irregularities in the location.

The Promise to Purchase

Have you found the perfect home? Now it’s time to write the Promise to Purchase (PTP), the official and mandatory document that tells the sellers that you want to buy their property. It is in this document that you indicate the price at which you wish to purchase the property as well as the conditions of your offer. The Promise to Purchase is a negotiating tool between the parties and is therefore negotiable.

The inspection

Although you may decide not to ask for a building inspection before signing the promise to purchase, your broker must recommend it! More information on this subject can be found in our guide for buyers.

AFTER the acceptance of the offer to purchase

The transfer of the property

Once the Promise to Purchase is accepted, the next step is to formalize the transaction. The two main components of this step are the title examination and the deed of sale. The transfer of the property requires the involvement of a notary. Again, your real estate broker plays a crucial role in ensuring that the required documents are available.

The deed of sale

The final step in the transaction is the drafting and signing of the deed of sale, in order to make the purchase of the property official. The notary will specify, among other things, the clauses and conditions essential to the protection of your rights.

See more real estate news

Real Estate Trends: An Overview of the First Quarter of 2024

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have meticulously scrutinized the emerging trends in the

The Promise to Purchase for an undivided co-ownership

The Promise to Purchase for an undivided co-ownership The Promise to Purchase an undivided property in Quebec differs significantly from that of a divided condominium.

Why invest in commercial real estate ?

Why invest in commercial real estate? Investing in commercial real estate represents a prudent financial strategy, offering a multitude of attractive advantages for savvy investors.

Réformes hypothécaires : vers un accès facilité à la propriété pour les Canadiens

Dès le 15 décembre prochain, il sera plus accessible pour la population canadienne d’acquérir une propriété grâce à deux nouvelles réformes mises en œuvre par

Leasing your property with a real estate broker

Leasing your proprety with a real estate broker – Key Information Residential renting is a common practice in Montreal, both among tenants and landlords. In

Real estate overbidding: how much should a buyer offer for a property?

How much a buyer should offer to purchase a proprety – Key Information Real estate overbidding: how much should a buyer offer for a property?