Real Estate Trends: An Overview of the First Quarter of 2024

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have meticulously scrutinized the emerging trends in the

Courtier Immobilier Montréal Yanick E Sarrazin

Découvrez le projet Terrasse St-Denis : une copropriété moderne dans un emplacement unique à deux pas du Centre-Ville. Résidez à proximité du Square Saint-Louis, du Parc La Fontaine, du métro Sherbrooke et du Quartier des Spectacles !

Espaces de vie vastes et lumineux, cuisines raffinées avec électroménagers haut de gamme et matériaux de qualité : l’unité récemment rénovée dispose de toutes les commodités nécessaires pour vous charmer.

Cette copropriété se trouve dans un emplacement de choix , sur une rue paisible dans le quartier vibrant de Ville-Marie. À proximité se trouvent le métro Sherbrooke, le Square St-Louis, le Parc La Fontaine, le Quartier des Spectacles, ainsi que de nombreux autres plaisirs urbains !

Tous les déplacements peuvent se faire facilement à la marche.

De nombreuses pistes cyclables et stations de BIXI à quelques minutes du Projet.

Cafés, restaurants et boutiques à perte de vue : les commerces sont nombreux dans Ville-Marie.

Un vaste choix de produits et de services vous sont offerts dans les alentours.

Voici un tour d’horizon de deux adresses à découvrir dans le secteur : Bouillon Bilk et le café-terrasse Osmo X Marusan.

Situé sur le boulevard Saint-Laurent, Bouillon Bilk est un restaurant réputé de la métropole. Ayant ouvert ses portes en 2011, ce chic restaurant a été désigné par le cabinet d’architectes Yelle Maillé et offre un look épuré et minimaliste.

Que propose-t-on chez Bouillon Bilk ? Une belle carte de vins, ainsi qu’une diversité de plats combinant simplicité et complexité. Le menu change selon les saisons et est constitué d’une protéine (crabe, pintade, morue etc.) et d’un accompagnement. L’un de nos mets préférés? Les pâtes qui regorgent de saveur !

Pour un lunch entre amis ou un souper d’affaires, nous vous recommandons vivement cette expérience gastronomique hors pair !

Communément appelé Café Osmo, ce café au look industriel de la rue Sherbrooke ouest est l’un des projets de MDT Mobilier et est spécialisé dans la cuisine japonaise. Sandos japonais, ebbi curry : les plats sont goûteux et diversifiés. Cet espace parfait pour travailler offre également du café d’une diversité de torréfacteurs pour le bonheur des caféinophiles.

Le soir, l’ambiance se transforme en club social : sakés, vins d’importation privée et DJ sont au rendez-vous ! Pour des séances de travail en journée ou des soirées conviviales entre amis, le Café Osmo est le lieu rêvé à découvrir !

Osmo X Marusan est situé au 6230 rue Saint-Hubert, dans Ville-Marie.

Should I sell my property before buying one or buy before selling my current property? Many people ask this question because of uncertainties in the process of selling and purchasing real estate.

Our real estate brokers, experts in Montreal neighbourhoods, believe that selling before buying is the best option. That said, each case is different and we will try to give you a picture of the advantages and disadvantages of the two scenarios in order to help you.

Fear of the unknown leads some individuals to opt for this sequence when they are looking for a new property. It is more precisely the fear of not finding the property that meets the criteria of purchase after receiving an interesting offer on their real estate that is at the heart of their concerns. That said, buying before the sale can be an attractive option in the case of a cash purchase.

• More time: Aside from your personal constraints, you have all the time you need to do your real estate searches.

• A purchase offer conditional on the sale: In the case where the buyer must sell to recover the proceeds of the sale in order to finance a new purchase of a property, when he finds the desired property, the latter must submit a purchase offer conditional on the sale of his property. Otherwise, there is a significant financial risk or a much higher purchase cost. Until you have an unconditional offer to purchase your property, there will be uncertainty about your purchasing power, including how much you can spend on your down payment.

• Additional costs incurred by a bridge loan: If you need the proceeds from the sale of your property for your purchase, your bank or lender can offer you the option of a bridge loan to acquire the desired property. However, it will cost several thousand dollars to cover the administrative costs, as well as the interest costs associated with granting the loan.

• A less competitive and more stressful offer to purchase: Writing an offer to purchase that includes the condition of sale makes your promise to purchase less attractive to the seller. In addition, once your offer to purchase is accepted, it will include a 72-hour clause. Thus, as long as the terms of your sale are not fulfilled, the 72-hour clause indicates that the seller can find another buyer. In general, the buyer’s deadline for fulfilment of the conditions is 30 to 90 days. This number may vary depending on the agreement between the seller and the buyer. If the seller receives an even more attractive offer from another buyer and the conditions are lifted before yours, the seller will have 72 hours to send you a notice, being the first buyer. You should then lift all your conditions, including the sale of your property and provide proof of the financing of the purchase. In short, the addition of this condition can raise many concerns and lead you to make concessions that you would not normally make.

• The risk of not selling: An additional disadvantage to buying before selling your property is not being able to sell your property once your buying process has begun. For example, you accepted an offer to purchase your property and during the inspection a problem affecting the building was discovered. Whether this problem is real or imagined, major or insignificant, the buyer can cancel his offer which will have catastrophic consequences on your own buying process, not to mention the loss of value of your property.

This sequence remains the most financially secure option as it involves selling your property and using the proceeds of the sale to acquire a new property.

• A reduction in financial risks: In most cases, the sale of a property helps finance the purchase of a new property. Selling your property allows you to recover the value of the property and then have a better knowledge of the actual budget allocated to the future purchase including the amount of your down payment. So it’s a safer option. In addition, the expenses are only related to one property, one mortgage, and you will not have the additional costs of a bridge loan.

• Better negotiating power: When you sell before you buy, you will have fewer constraints since you have no commitment to buy real estate. In this sense, since you will not feel a sense of urgency, you will have less pressure to sell and will therefore be less inclined to accept an offer that does not meet your expectations, which will result in a higher sales price. You’ll have more bargaining power.

• A more competitive offer to purchase: As mentioned, with the sale price of your property, you have a better idea of the amount you will pay on the new property. You will not have to submit an offer conditional on the sale of your property. You can then make offers to purchase with only the basic conditions (inspection, financing and document review).

• The impossibility of finding the desired property: The main drawback of the pre-purchase sale that worries some homeowners is not being able to find a property that fits their needs once their current home is sold. This could result in a temporary rental while finding the ideal property. That said, with the assistance of an expert real estate broker in your neighbourhoods for the sale of a property and the purchase of a new one, this scenario can be avoided.

Selling and/or buying your property is an important event that can generate considerable stress and where constraints and uncertainties can occur. In order to simplify this process, to obtain better purchasing power and especially to reduce financial risks, it is generally recommended to sell your property before buying a new one.

In addition, in our opinion, the key to success is to accept an offer to purchase in which the deadline for signing the act of sale is more than 90 days, while being accompanied by a real estate broker who has a great deal of expertise in the acquisition of real estate.

Still hesitating about the right decision? Contact one of our real estate brokers who will enlighten you on the subject and according to your needs.

There are many questions about whether it is better to sell your property before buying a new one or whether it is better to buy before selling. According to our team of experts, it is always preferable to sell your property before making a new acquisition of real estate. The benefits are many: you reduce financial risks, you will have more time to make an informed decision about the sale and purchase of a new property. When you make an offer to purchase, you will have fewer conditions, which can then attract more sellers. Selling before purchasing a new property helps alleviate worries about this important event of a lifetime. As for the purchase before the sale, this option is interesting only in the case of a cash purchase. If you have additional questions, do not hesitate to contact a YE/SARRAZIN real estate broker !

This article was updated on August 24, 2022.

Given the current overheated real estate environment and in the interest of better protecting buyers in a real estate transaction in Quebec, Bill 5 was passed by the National Assembly. This amendment to the Real Estate Brokerage Act was adopted on June 10, 2022. Bill 5 involves various tax measures, but also measures related to the real estate market. It prohibits, among other things, the dual agency of a real estate broker with a buyer and a seller for a residential immovable, as well as the verbal brokerage contract. These measures would then avoid a potential conflict of interest.

With the arrival of this new law, many questions arise. What exactly does this law consist of? What are the benefits for buyers? Does it have any exceptions regarding its application? What are the advantages of the brokerage purchase contract for buyers? What is the opinion of our team’s real estate brokers regarding this important change?

As mentioned previously, Bill 5 prohibits a real estate broker from representing a buyer and a seller at the same time in a transaction involving a residential immovable property. A real estate broker is licensed by the Organisme d’autoréglementation du courtage immobilier du Québec (OACIQ). The broker works with his client, must protect his interests and ensure loyalty. Respect for confidential customer information is essential. In a case of dual agency, these obligations cannot always be fulfilled and can give rise to major conflicts of interest, hence the importance of the establishment of this law.

The real estate broker must then represent only one part of the transaction (the buyer/the seller or the tenant/the lessor), thus ensuring a fairer treatment vis-à-vis the buyer.

The prohibition of dual agency is also combined with the prohibition of the verbal purchase brokerage contract. A written purchase brokerage contract must then be established between the buyer and the real estate broker in order to formalize the transaction.

If a case of dual agency occurs, i.e. a real estate broker is bound by a sale brokerage contract and a purchase brokerage contract, he must then notify the buyer in writing as to the termination of the purchase contract. As soon as this writing is sent, the termination of the purchase contract takes effect. The broker will then have to recommend a new real estate broker to this buying client. However, the buying client can choose not to be represented by anyone and make the decision they desire for the rest of the real estate transaction. If this is the case, the real estate broker must grant him fair treatment.

The concept of fair treatment is fundamental here. The real estate broker must inform the unrepresented buyer with objectivity. Indeed, the broker must demonstrate the accuracy of the information transmitted and indicate to the buyer any adverse elements concerning the desired property. However, the representation of the buyer and the defense of his interests are not possible without the signature of the purchase contract. In this case, the real estate broker will work in collaboration with the broker-seller.

It should be noted that the OACIQ will establish certain exceptions with regard to compliance with the law of double agency. For example, for certain regions of Quebec that would be underserved, real estate brokers in that region would be authorized to represent buyers and sellers. Additional exceptions are expected in the coming months.

Broker-Seller: The broker-seller is the real estate broker who is bound by a Brokerage Sale Contract (BSC) with a seller. Since the broker has a signed contract, he must represent his client’s interests.

Broker-Buyer: The broker-buyer is the real estate broker who is bound by a Brokerage Purchase Contract with a buyer (BPC). He can therefore represent the buyer and must defend his interests.

Broker-Collaborator: The broker-collaborator is the real estate broker who accompanies the buyer in the transaction, but is not bound by a brokerage purchase contract (BPC). As mentioned above, the broker-collaborator must work in collaboration with the broker-seller and cannot represent the buyer and his interests.

Among the new obligations of this law, the brokerage purchase contract became mandatory as of June 10, 2022. In order to formalize the agreement between the buyer and the broker, the purchase contract must be signed by both parties. Signing this type of brokerage contract has many advantages for buyers:

The OACIQ has established certain exceptions regarding compliance with the dual agency law.

-For certain areas of Quebec that would be underserved, real estate brokers in that area would be allowed to represent buyers and sellers.

-A seller and a buyer can be represented by two brokers from the same real estate agency.

-For residential buildings with more than 5 units and commercial buildings, the brokerage purchase contract is not mandatory. The end of dual agency does not apply here.

Bill 5 was adopted by the National Assembly and involves changes to the law on real estate brokerage. These changes have been in effect since June 10, 2022. Among other measures, this new law prohibits the dual agency of a real estate broker with a buyer and a seller for a residential building. It also indicates that in order to formalize a transaction, a written brokerage purchase contract must be established between the two parties. Certain exceptions to this dual agency will be granted, such as in small regions of Quebec where there is a deficit of real estate brokers. It also states that in order to formalize a transaction, a written brokerage purchase contract must be established between the two parties. With the mandatory purchase brokerage contract, this reduces potential conflicts of interest that can arise when a real estate broker represents a buyer at the same time as a seller. In addition, this provides additional protection to the buyer, strengthens the relationship of trust and loyalty between the two parties.

*The use of the pronoun “He” was used to lighten up the text.

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have meticulously scrutinized the emerging trends in the

The Promise to Purchase for an undivided co-ownership The Promise to Purchase an undivided property in Quebec differs significantly from that of a divided condominium.

Why invest in commercial real estate? Investing in commercial real estate represents a prudent financial strategy, offering a multitude of attractive advantages for savvy investors.

You are looking for a property in Montreal with your real estate broker. When you search online, the detailed sheets of properties have the mention of “sale without legal warranty of quality, at the buyer’s risk and peril. As you are not certain of the meaning of these terms and their implications, you then ask your real estate broker for further information.

Your real estate brokers answer all your questions:

In Quebec, the law provides that the sale of real estate must guarantee the quality and the right of ownership. These two guarantees constitute the legal warranty.

The guarantee of quality concerns hidden defects. When we talk about hidden defects, we are talking about a “hidden” defect that will undermine the quality of the building. This defect is known by the seller and has been omitted from the Seller’s Declaration (VIS). In addition, the hidden defect existed at the time the purchase but was unknown to the buyer. The hidden defects are not usually not easily noticeable and can be for example mold in the walls, cracks in the foundations, moisture on the ground, water infiltrations, etc.

The guarantee of the right of ownership (security of title) is related to the vices of title of ownership. This would refer to a situation that would prevent the buyer from exercising his right of ownership. For example, the seller would not have repaid his mortgages in full and would have failed to mention it to the buyer.

A sale without legal warranty implies that the buyer agrees to acquire the property at his “ own risk and waives’’. This means that in the case of hidden defects, recourse against the seller is limited, hence the importance of pre-purchase inspection. The seller should still indicate the past defects and complications with the property and must act in good faith, in order to be transparent. The buyer must read it, but understands that he or she has no guarantee on the quality of the property.

For a sale without legal warranty to take place, there must be a mention in the Seller’s Declaration or the Offer to Purchase. This must also be indicated in the act of sale.

The phenomenon of sale without legal warranty has been observed in real estate transactions for several years in Quebec. However, this phenomenon has grown since 2019, during the pandemic. Buyers may decide to waive the legal warranty in order to acquire the coveted property more easily. Sellers, on the other hand, sell their property without legal guarantee, thinking that they will let go of their responsibility. But is it really a good idea?

Selling without a legal warranty has significant negative impacts, especially on the value of the property. Indeed, according to a report from JLR, a property sold without legal warranty would be sold 8% to 11% less than with.

In addition, in order to make an offer more attractive, a buyer can waive the legal warranty and abandon the pre-purchase inspection. The buyer then has no recourse against the seller and is then responsible for the hidden and apparent defects of the property. Fixing these defects can result in a considerable amount of money, which is never desirable.

The reference to “at your own risk and waives” should be taken seriously.

Some sellers opt to sell their property without legal guarantee. However, it is in these 3 following situations that the sale without legal warranty is the most common.

– Senior sellers: Senior sellers often decide to sell their property without a legal warranty in order to avoid liability as they approach retirement. They then move towards a smaller home.

-Estates: the heirs of a property may not have a good knowledge of its history. Indeed, the property may be old and they do not know if there have been problems in the past regarding the quality of the building. In order to protect themselves and avoid the risk of potential lawsuits, the heirs will then sell without legal warranty.

-Bank repossessions: when an owner no longer pays his mortgage, a formal notice is sent and a court judgment is issued a few months later. The bank then takes possession of the property and makes a direct sale. The buildings taken over by the banks are always sold without legal warranty, as a bank does not want to be sued for hidden defects.

Growing in popularity, selling without a legal warranty is a risky and high-risk practice. Before selling, ask your real estate broker for an expert opinion on the subject, which will guide you to the most informed decision.

The phenomenon of sale without legal warranty has been observed in real estate transactions for several years in Quebec. However, this phenomenon has grown recently with the pandemic. Sale without legal warranty implies that the buyer agrees to acquire the property at his “own risk and waives’’. This means that in case of hidden defects, no recourse against the seller will be possible, hence the importance of the pre-purchase inspection. In these three situations the sale without legal guarantee is more common: when the seller is an older person, during a succession or a bank resumption. Despite its growing popularity, selling without a legal guarantee is not recommended because it is a dangerous practice that does not provide protection to the buyer.

In Montreal – whether in the Plateau Mont-Royal, Rosemont La Petite-Patrie or Villeray areas – you’ll find a

If you’re looking for your new home, chances are you’ve already noticed the Repossession search criterion on Centris,

Montreal, April 16, 2025 – The Bank of Canada has decided to maintain its key rate at 2.75%.

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have

The Promise to Purchase for an undivided co-ownership The Promise to Purchase an undivided property in Quebec differs

Why invest in commercial real estate? Investing in commercial real estate represents a prudent financial strategy, offering a

After much research and visits with your real estate broker, you have finally acquired the dream property. Now is the time to move.

Moving is an important step in anyone’s life. This change would be one of the greatest sources of anxiety in human beings… and the same goes for our 4-legged friends. Indeed, our pets are creatures of habit and moving is, in many cases, the ultimate upheaval. Our real estate brokers offer you 6 tips that will hopefully make moving to your new property with your little pal easier.

Our Real Estate Intern Bibi is ready for her move.

In order to accustom your pets to living temporarily with boxes, start storing their items early. Place less used items in the boxes and leave them open. Your pets may be curious at first, but soon they won’t give them a second glance. Packing your pets ahead of time will help reduce the anxiety and disruption of the move as the big day approaches and the packing starts to get heavy.

It’s a good idea to schedule a visit with your vet a few weeks before moving so you can do the following:

-Request a copy of your pet’s medical records if you move away from your current neighborhood or city and need to change veterinarians;

-Check that all vaccines are up to date;

-Discuss potential stress reduction tactics or supplements to help relieve your pet’s anxiety.

During the moving process, the doors may be left open and the movers may make many round trips to the home. Make sure your pet wears a collar with your updated contact information and cell phone number. Thus, in the event that your companion flees during the move, this will facilitate contact for his quick and safe return home. Whether you are moving to Villeray, Rosemont or Le Plateau, you must ensure that your cat or dog wears a tag issued by the City at all times, except in the case of a microchipped cat.

*Did you know? Nearly 1 in 3 animals are lost at some point in their life and

only 10% of animals lost without identification are reunited with their owner.

Reduce the stress of moving for you and your pet by having all of your pet’s necessities packed up and close at hand: their food (and treats), their favorite blanket and/or stuffed animal, and toys. In the event of an emergency, have your veterinarian’s contact information, duct tape and towels handy.

Don’t forget a roll of paper towels and disposable plastic bags to help with unexpected clean-ups!

Boxes, mountains of clothes, half-dismantled furniture… A move can quickly turn your once organized home into one big mess. Whether it’s a small room, a corner or even an open closet, having a place for your pet to retreat to when chaos overwhelms it is essential, especially for cats and dogs. Put its blanket, crate, or carrier somewhere comfortable, away from the hustle and bustle of the move, but not too far away that it can hear you.

The best place for your pet is in its crate or carrier located in the backseat and restrained by a seat belt. Make sure the straps are secure in case of an accident and that there are no objects or boxes that could fall and hurt your pet. You can put a blanket over your pet’s crate to reduce visual stimulation if you think this will help reduce their anxiety.

In order for your move with your pet to go smoothly, it is recommended to follow these 6 practical tips shared by your real estate brokers in Montreal. However, as far as possible, keeping your pet on the day of the move remains the best solution to limit the anxiety of this little being. The risk of leakage is also reduced. Why not contact a loved one to look after your companion for a day? Peace of mind and tranquility guaranteed!

Moving represents considerable anguish for humans and… their pets. Our team of real estate brokers offers you 6 practical tips to make your move with your four-legged friend go smoothly. Before the move, it is important to get your pet used to packing boxes and other supplies in advance, contact your veterinarian to ensure your pet’s record is up to date, and create a new tag for your pet’s collar. Address and telephone number must be entered there. Preparing a first aid kit with all of your pet’s necessities is also an important step before the move. On D-Day, keep a comfortable and isolated space for your pet and prepare your companion for a safe trip in your vehicle. However, keeping your pet on all fours on moving day remains the best solution to limit your beloved pet’s anxiety. We wish you a smooth move to your new home!

Dès le 15 décembre prochain, il sera plus accessible pour la population canadienne d’acquérir une propriété grâce à

Leasing your proprety with a real estate broker – Key Information Residential renting is a common practice in

How much a buyer should offer to purchase a proprety – Key Information Real estate overbidding: how much

In a seller’s market, the number of properties for sale is not sufficient to meet the demand. It is not uncommon for more than one buyer to be interested in the same property, and this is even more the case in the more desirable areas of the city of Montreal. As a buyer, you can sometimes find yourself in a multiple offers situation and overbidding, which can seem tricky and even discouraging. However, there are several strategies to consider in this situation to increase your chances of winning.

Here are 7 that can help you :

Define what criteria are really important to you when you begin your search for a new property. If your criteria are not well defined, you may not have enough time to evaluate the neighborhood and the characteristics of the properties (neighborhood schools, number of rooms needed, maximum budget, etc.). By having clear criteria, you will reduce stress and focus on the opportunities that really meet your needs.

In a multiple offer situation, the selling price is usually higher than the asking price. A real estate broker who knows the Montreal market well will be able to advise you on the price at which a property should sell and help you set the right price for your offer.

His knowledge of neighborhoods, recent transactions and the legal aspects of a real estate transaction will give you access to all the information you need to make informed decisions. In addition, he will be able to put his network of trusted professionals (appraisers, mortgage brokers, notaries, etc.) at your disposal so that you will be ready when the time comes to fulfill the conditions of your promise to purchase.

It is important to know that in a multiple offer situation, you will not be able to know the conditions offered by the other buyers, including the price. Although the seller’s broker must advise you of the number of offers, no other element can be mentioned.

In order to demonstrate your intentions and commitment to the seller, it is strongly recommended that you obtain a mortgage pre-approval from your financial institution in addition to your down payment. This letter will demonstrate to the seller that you are not financially locked in. You can also obtain a proof of funds which will further reassure the seller.

The price is not the only element considered at the time of a purchase. In fact, other clauses such as the occupancy date play a major role in the sellers’ decision. If you are flexible with the date of signing or taking possession, or with inclusions/exclusions, talk to your broker or the seller’s broker (if you are buying alone). They will be able to give you more details on the sellers’ expectations.

The more your terms accommodate the seller’s preferences, the more likely you are to get their attention. There is also the option of making an offer not conditional on an inspection. Although this option is more risky, it is best to discuss it with your real estate broker first.

If the seller wants 48 or 72 hours, do not try the option of reducing the time to 24 hours. This may have a negative effect, rushing the seller who is receiving multiple offers.

Sellers are often emotionally attached to their property, they often want to know the next people who will live there and their plans. By taking the time to write a presentation letter, prepare a video or a photo collage, you increase your chances of showing that you are the ideal buyer. Don’t forget to present your family, your projects or your background, they might recognize themselves in you!

It is suggested to set deadlines as short as possible, while remaining realistic. A serious and ready buyer should have all the information ready in case of an accepted offer to start the process. Consult your inspector in advance to find out the minimum notice period he needs, or your bank or mortgage broker for financial approval deadlines.

If you find the property of your dreams or are looking for a home in an area where listings are scarce, discuss with your broker the option of increasing your offer. Offering your highest price may get you the property you want. If your offer is not accepted, and you have a strong interest in the property, you can put in a second offer. This option ensures that your offer will be accepted if the initial offer falls through.

The Montreal market is as active as ever and properties are selling at a record pace. It is therefore strongly suggested to act quickly. Don’t wait for the visit to see the street or the area of the property. Come by during the day and evening to see the façade and exterior, and if there is an alley, visit it. Respect the seller’s requests regarding the deadline for submitting offers.

If you choose a real estate broker, take the time to check out the reviews of buyers and sellers on Google, to see what they thought of the service offered. After all, it’s people like you who will give you a real idea of what to expect.

Happy searching, and especially happy transactions!

Quebec mores In Quebec, it has been customary for many years for the majority of leases to end on July 1. Although July 1st coincides

As Quebec’s national holiday approaches, are you wondering what to do in the metropolis? Our team of real estate brokers in Montreal has put together

Montreal, May 24, 2025 – Last week, the Michelin Guide unveiled its long-awaited list of the best restaurants in Quebec. Our team of real estate

Are you looking for a property? You are getting ready to make your first real estate investment and are looking for information and advice on the steps and procedures to follow to complete this major project.

Our team of real estate brokers has prepared a summary document, inspired by the OACIQ Buyer’s Guide, which outlines the main steps to follow in order to carry out your project in complete confidence.

Here is a summary of the main topics covered in this buyer’s guide.

The first important step is to establish your budget. Indeed, it is important that it takes into account your lifestyle, your daily expenses, your payments, your debts, while taking into account your medium and long term objectives.

This way, you will know exactly what budget you can allocate to the purchase of a property, in addition to directing your search in the right direction, towards homes that respect your budget limit.

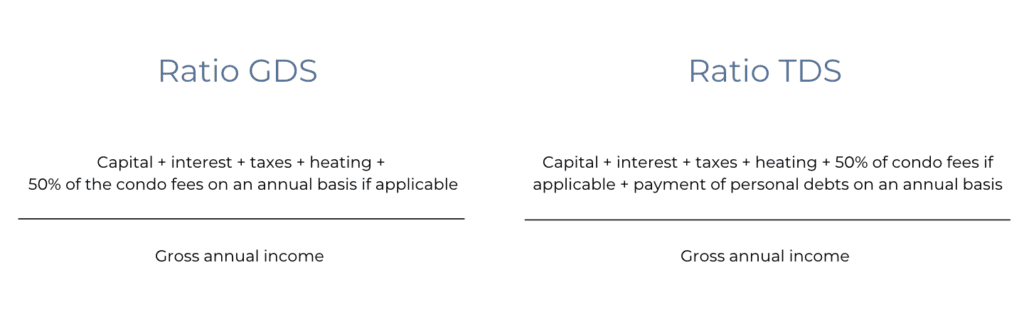

It will then be important to have a mortgage pre-approval that assesses your ability to borrow from the bank. This document will be given to you by a mortgage broker, who will probably use one of the following two ratios :

You will then need to determine the amount of your down payment, which is the amount you will have to pay when you purchase the property. This amount will then be deducted from the purchase price of the property. This amount will depend on the type of property you are purchasing (divided co-ownership, undivided, income property, etc.).

As a real estate buyer, you should also set aside a preventive amount to cover the inspection, notary fees, transfer duties and all other expenses related to the acquisition of a property, as well as any unforeseen circumstances that may arise.

Also note that if this is your first real estate purchase, the HBP (Home Buyer’s Plan) may be of interest to you! Consult our guide to find out more about it.

Also, be sure to define your search criteria, the geographic area you are looking for, the type of neighborhood you want to live in, your needs, restrictions, etc. A detailed sheet in our buyer’s guide will help you narrow down your search criteria.

Contact one of our real estate brokers to help you establish your criteria.

If you wish to do business with a professional in the sector, discover our real estate brokers in Montreal who will be pleased to accompany you in your steps. Real estate professionals are protected by the Real Estate Brokerage Act, which, as mentioned by the OACIQ, will help protect you during your transaction.

In addition, real estate brokers generally have a network of contacts that will allow you to surround yourself with the best experts in each of the fields necessary for a successful transaction: mortgage broker, notary, inspector and others.

The Seller’s Declaration is the document in which the seller records all the information he or she is aware of about his or her property that may help future buyers make up their minds about the property, including any defects or irregularities in the location.

Have you found the perfect home? Now it’s time to write the Promise to Purchase (PTP), the official and mandatory document that tells the sellers that you want to buy their property. It is in this document that you indicate the price at which you wish to purchase the property as well as the conditions of your offer. The Promise to Purchase is a negotiating tool between the parties and is therefore negotiable.

Although you may decide not to ask for a building inspection before signing the promise to purchase, your broker must recommend it! More information on this subject can be found in our guide for buyers.

Once the Promise to Purchase is accepted, the next step is to formalize the transaction. The two main components of this step are the title examination and the deed of sale. The transfer of the property requires the involvement of a notary. Again, your real estate broker plays a crucial role in ensuring that the required documents are available.

The final step in the transaction is the drafting and signing of the deed of sale, in order to make the purchase of the property official. The notary will specify, among other things, the clauses and conditions essential to the protection of your rights.

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have meticulously scrutinized the emerging trends in the

The Promise to Purchase for an undivided co-ownership The Promise to Purchase an undivided property in Quebec differs significantly from that of a divided condominium.

Why invest in commercial real estate? Investing in commercial real estate represents a prudent financial strategy, offering a multitude of attractive advantages for savvy investors.

Dès le 15 décembre prochain, il sera plus accessible pour la population canadienne d’acquérir une propriété grâce à deux nouvelles réformes mises en œuvre par

Leasing your proprety with a real estate broker – Key Information Residential renting is a common practice in Montreal, both among tenants and landlords. In

How much a buyer should offer to purchase a proprety – Key Information Real estate overbidding: how much should a buyer offer for a property?

The real estate broker has well known responsibilities and tasks. However, he or she can be accompanied and work closely with an assistant who has a central role in the real estate transaction, but whose tasks are often unknown. How is an assistant essential in a real estate team?

The Real Estate Broker’s Assistant will take care of various administrative and management tasks for the real estate brokers on the team. In fact, with the collaboration of the real estate broker, the assistant will assemble the various client files and ensure the conformity of the documents received during the real estate transaction process. This is an important step since the documents must be completed according to the real estate brokerage law.

Updating client databases and preparing information for market analysis are also among the many tasks associated with the Broker Assistant job.

The work of a Real Estate Broker’s Assistant also involves composing and preparing communications necessary for transactions, as well as managing calls and information requests from prospects and clients. The assistant may contact sellers and buyers to pass on the necessary information to the real estate broker. During the marketing of properties, the Real Estate Broker Assistant will work with the broker to ensure that the real estate transaction runs smoothly.

In order to become a Broker’s Assistant, it is recommended to have knowledge in real estate and to be passionate about this field. Training is also available to learn more about the lexicon of real estate in Quebec and the various Centris computer tools to know (Immocontact, Matrix, Prospect, Instanet Forms, Saisie), Ezmax and EZSign.

The organisme d’autoréglementation du courtage immobilier du Québec (OACIQ) is the authority on real estate brokerage in Quebec. It is an important resource that has a lot of relevant information to know and can be very useful for the training of a broker’s assistant.

As mentioned earlier, the real estate assistant plays a fundamental and important role in a real estate team. She must have a sharp sense of organization and outstanding customer service. The ability to manage numerous files at the same time, as well as a high level of professional rigor, must also be part of their skills.

The real estate broker’s assistant must therefore be in perfect synergy with the real estate broker, as she follows everything the broker undertakes at each step of the real estate transaction process. The broker’s assistant is therefore a fundamental pillar for the real estate brokers on the team.

The YE/SARRAZIN Team is fortunate to be surrounded by several real estate broker assistants who also hold their real estate broker’s licenses. Thus, our operations team has a wide range of real estate knowledge. This diversity of knowledge and skills brings a lot of rigor to the team’s files.

The Real Estate Broker Assistant has very specific tasks and follows the brokers in the administration and management of the various client files. Her tasks are numerous, ranging from updating client files, writing various communications to making calls with sellers or buyers during the real estate transaction. There is no specific training to become a broker’s assistant. However, a basic knowledge of real estate and a passion for this field are required. A strong sense of organization and unparalleled customer service are also qualities to have for a real estate broker’s assistant.

Dès le 15 décembre prochain, il sera plus accessible pour la population canadienne d’acquérir une propriété grâce à deux nouvelles réformes mises en œuvre par

Leasing your proprety with a real estate broker – Key Information Residential renting is a common practice in Montreal, both among tenants and landlords. In

How much a buyer should offer to purchase a proprety – Key Information Real estate overbidding: how much should a buyer offer for a property?

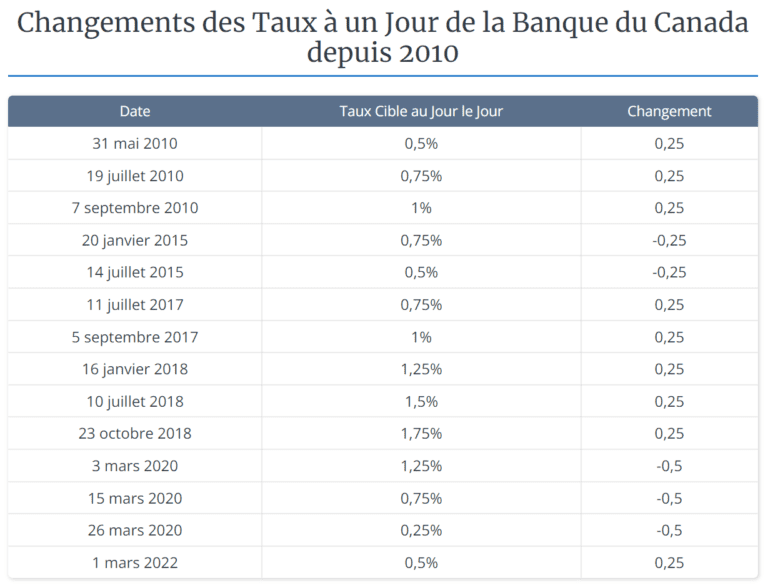

In our current context of pandemic and real estate market overheating, the threat of an increase in the key interest rate has been hovering for several months. Recently, the Bank of Canada raised the rate to 0.50%. This interest rate had not increased since the beginning of the COVID-19 pandemic in 2020.

Many questions and uncertainties remain about the impact of this rate fluctuation on the real estate market. To shed some light on the key interest rate and its influence on the real estate market, we spoke with Mahsa Mirzaie, Director of Mortgage Development at National Bank.

The objective of raising the key interest rate is to curb inflation around the world by reducing borrowing costs and encouraging savings. It is important to understand that at the beginning of the pandemic, the key interest rate was reduced three times to reach 0.25% to stimulate the economy. This rate, reached in March 2020, had never been so low, allowing the economy to recover.

Source : la Banque du Canada

When central banks raise their interest rates, the base rate of chartered banks (such as the National Bank of Canada, the Bank of Montreal, the Royal Bank of Canada) also increases, because it costs them more to finance themselves. The consequence is that several bank products with interest rates increase, such as mortgage interest rates, rates on credit margins, and other products with variable interest.

Customers that already have a fixed-rate mortgage, the interest rate will not be affected by this increase until their mortgage is renewed. The rate is set for the duration of the contract. When the contract is renewed, the new rates take effect.

Customers that already have their mortgage with a variable interest rate will have to expect a rise as fast as the following month.

Now, for customers who are currently looking for a mortgage, it is recommended to do a pre-approval with rate guarantee as soon as possible. Indeed, despite the fact that there has been a first increase in the key interest rate, according to the forecasts, future increases in interest rates are to be expected. We must then protect ourselves against them.

According to Yanick E. Sarrazin, the team’s chief real estate broker, although the real estate market has been very interesting for several years, it should not be forgotten that the evolution of this market depends on the relationship between supply and demand. A disparity therefore creates an upward or downward impact on property prices.

Higher rates are expected to result in fewer buyers, which could reduce or stagnate future increases in property values. Some may think that this could lower the price of houses in Montreal. Mr. Sarrazin’s opinion differs since the average prices of properties in Montreal have not witnessed a loss in value in the past decades. Indeed, Mahsa Mirzaie, adds that it would be unlikely unless we find exorbitant rates at 5-6% as those before the year 2000.

Historically speaking, real estate remains a good investment in the long term considering that properties increase in value over time.

However, many are wondering whether it is better to acquire a property right now or to wait, given the situation. From an investment point of view, it would be wiser not to wait to purchase a property given that the prices of properties have always seen an increase, strong or weak.

That being said, a mortgage broker understands that each individual’s situation varies. The financial stability of the buyer is a key element, hence the importance of a mortgage broker assessing one’s financial situation. This analysis can then provide an overall picture of the individual’s income, borrowing capacity and repayment capacity.

Once the financial analysis is done, it is also important to target the objective of the purchase, as the strategy to adopt will be different. For example, is the purchase for a primary residence? There will then be no tax impact on the sale unlike a purchase of a rental property, in this case, the strategy of cash damming will be interesting.

Since it can take a long time to acquire the desired property, it is recommended to do a pre-approval with guaranteed rates with the longest period possible. This then ensures no fluctuation of the rate for a fixed period.

Depending on the objectives of your real estate purchase, there are multiple strategies and can be complex, hence the importance of getting in touch with a mortgage broker who will advise you and guide you towards the right direction.

This article was written in partnership with Mahsa Mirzaie, mortgage development manager at National Bank.

Quebec mores In Quebec, it has been customary for many years for the majority of leases to end

As Quebec’s national holiday approaches, are you wondering what to do in the metropolis? Our team of real

Montreal, May 24, 2025 – Last week, the Michelin Guide unveiled its long-awaited list of the best restaurants

The sale of a condo, house or plex is an important step for anyone and requires preparation. Indeed, a property must be well prepared for sale in order to arouse any interest: the first impression counts. After all, buying a property often goes through a lightning bolt or falling in love with different characteristics of the latter.

With the arrival of Valentine’s Day and the current real estate bustle, our team got together and spoke with the Metro Journal to establish 6 practical tips essential to seduce potential buyers. These tips have the specific purpose of achieving the desired effect, namely the sale of the property. To discover these 6 tips, consult the Petit Guide de Séduction immobilière.

In order to further entice potential buyers when visiting your property, we have established 5 additional tips. Here is their overview:

Cleanliness is an important determinant in the success of selling your property. A clean property is more attractive. Every room should be carefully cleaned. You have to be sure to empty the garbage cans, clean the floors, make the beds and dust the furniture. Closets are not to be neglected either, as potential buyers could be curious and open them during visits.

In a property, the kitchen and bathroom are rooms where extra attention should be paid. These pieces are naturally more ‘combed’ because of their utilitarian character and must then be immaculately clean.

To seduce a buyer is also to make sure that he/she can imagine living in said property. Depersonalization is essential and refers to removing elements that may harm the sense of belonging of the potential buyer. For example, remove family photos or travel souvenir frames from walls. Your clothes or shoes should not be lying around the property either. It is then important to create a neutral environment where the buyer will be comfortable and ‘feel at home’.

Home staging is a method to improve the ergonomics and aesthetics of a room. This technique includes moving furniture, adding decorative elements to the room or rearranging the entire space to make it more welcoming. Your real estate broker has the knowledge in this area and can help you to carry out an efficient and attractive home staging for the buyer. Don’t hesitate to ask your real estate broker for advice!

The seduction of a buyer also depends on the calm he can experience during his/her visit. Make sure the windows are properly closed, the radio is turned off and your neighbors are not undergoing major renovations. A calm environment inspires trust and is then much more seller for a buyer.

Pets are very cute, but they can sometimes create unfortunate situations. For example, during visits, a potential buyer may be uncomfortable with the presence of an animal or even allergic. Whenever possible, keep your pet with a loved one or bring it with you during visits to avoid unpleasant situations.

With these 5 handy tips for selling your property, the seduction of your buyers is almost guaranteed. It is now the turn of the expertise of your real estate broker to ensure his/her love at first sight!

Our team has established 5 practical tips to seduce potential buyers during the sale of his property: do the big cleaning, depersonalize the spaces, bet on elements of home staging, provide a tranquil environment and if you have pets, if possible, have them kept. For tips inspired by Valentine’s Day, we invite you to read our article published in the Metro Journal!

Dès le 15 décembre prochain, il sera plus accessible pour la population canadienne d’acquérir une propriété grâce à deux nouvelles réformes mises en œuvre par

Leasing your proprety with a real estate broker – Key Information Residential renting is a common practice in Montreal, both among tenants and landlords. In

How much a buyer should offer to purchase a proprety – Key Information Real estate overbidding: how much should a buyer offer for a property?