Raise in key interest rate - Key informations

In our current context of pandemic and real estate market overheating, the threat of an increase in the key interest rate has been hovering for several months. Recently, the Bank of Canada raised the rate to 0.50%. This interest rate had not increased since the beginning of the COVID-19 pandemic in 2020.

Many questions and uncertainties remain about the impact of this rate fluctuation on the real estate market. To shed some light on the key interest rate and its influence on the real estate market, we spoke with Mahsa Mirzaie, Director of Mortgage Development at National Bank.

Why does the Bank of Canada increase the key interest rate?

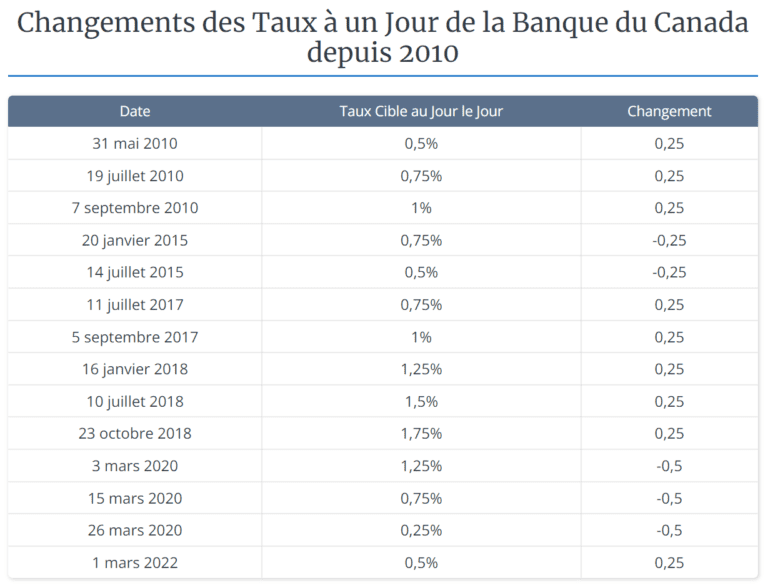

The objective of raising the key interest rate is to curb inflation around the world by reducing borrowing costs and encouraging savings. It is important to understand that at the beginning of the pandemic, the key interest rate was reduced three times to reach 0.25% to stimulate the economy. This rate, reached in March 2020, had never been so low, allowing the economy to recover.

Source : la Banque du Canada

How does the increase in the Key Rate affect mortgage interest rates?

When central banks raise their interest rates, the base rate of chartered banks (such as the National Bank of Canada, the Bank of Montreal, the Royal Bank of Canada) also increases, because it costs them more to finance themselves. The consequence is that several bank products with interest rates increase, such as mortgage interest rates, rates on credit margins, and other products with variable interest.

How does this affect current and future bank customers?

Existing customers

Customers that already have a fixed-rate mortgage, the interest rate will not be affected by this increase until their mortgage is renewed. The rate is set for the duration of the contract. When the contract is renewed, the new rates take effect.

Customers that already have their mortgage with a variable interest rate will have to expect a rise as fast as the following month.

Future customers

Now, for customers who are currently looking for a mortgage, it is recommended to do a pre-approval with rate guarantee as soon as possible. Indeed, despite the fact that there has been a first increase in the key interest rate, according to the forecasts, future increases in interest rates are to be expected. We must then protect ourselves against them.

What is the impact of the increase in the key interest rate on the real estate market?

According to Yanick E. Sarrazin, the team’s chief real estate broker, although the real estate market has been very interesting for several years, it should not be forgotten that the evolution of this market depends on the relationship between supply and demand. A disparity therefore creates an upward or downward impact on property prices.

Higher rates are expected to result in fewer buyers, which could reduce or stagnate future increases in property values. Some may think that this could lower the price of houses in Montreal. Mr. Sarrazin’s opinion differs since the average prices of properties in Montreal have not witnessed a loss in value in the past decades. Indeed, Mahsa Mirzaie, adds that it would be unlikely unless we find exorbitant rates at 5-6% as those before the year 2000.

What would be your advice for today’s buyers?

Historically speaking, real estate remains a good investment in the long term considering that properties increase in value over time.

However, many are wondering whether it is better to acquire a property right now or to wait, given the situation. From an investment point of view, it would be wiser not to wait to purchase a property given that the prices of properties have always seen an increase, strong or weak.

That being said, a mortgage broker understands that each individual’s situation varies. The financial stability of the buyer is a key element, hence the importance of a mortgage broker assessing one’s financial situation. This analysis can then provide an overall picture of the individual’s income, borrowing capacity and repayment capacity.

Once the financial analysis is done, it is also important to target the objective of the purchase, as the strategy to adopt will be different. For example, is the purchase for a primary residence? There will then be no tax impact on the sale unlike a purchase of a rental property, in this case, the strategy of cash damming will be interesting.

Since it can take a long time to acquire the desired property, it is recommended to do a pre-approval with guaranteed rates with the longest period possible. This then ensures no fluctuation of the rate for a fixed period.

Depending on the objectives of your real estate purchase, there are multiple strategies and can be complex, hence the importance of getting in touch with a mortgage broker who will advise you and guide you towards the right direction.

This article was written in partnership with Mahsa Mirzaie, mortgage development manager at National Bank.

- Mahsa Mirzaie, BNC

- mahsa.mirzaie@bnc.ca

Consult other real estate news

July 1: Moving in Quebec | Tips and Tricks

Quebec mores In Quebec, it has been customary for many years for the majority of leases to end

St-Jean-Baptiste: What’s open or closed on June 24?

As Quebec’s national holiday approaches, are you wondering what to do in the metropolis? Our team of real

Montreal’s culinary scene honored by Michelin Guide

Montreal, May 24, 2025 – Last week, the Michelin Guide unveiled its long-awaited list of the best restaurants