The Promise to Purchase for an undivided co-ownership

The Promise to Purchase an undivided property in Quebec differs significantly from that of a divided condominium. The unique nature of undivided property requires special attention when drafting the purchase agreement. Understanding the essential aspects of this transaction is crucial for both buyers and sellers involved in this type of real estate transaction. Our real estate brokers in Montreal present to you the main differences and implications to consider in this type of transaction.

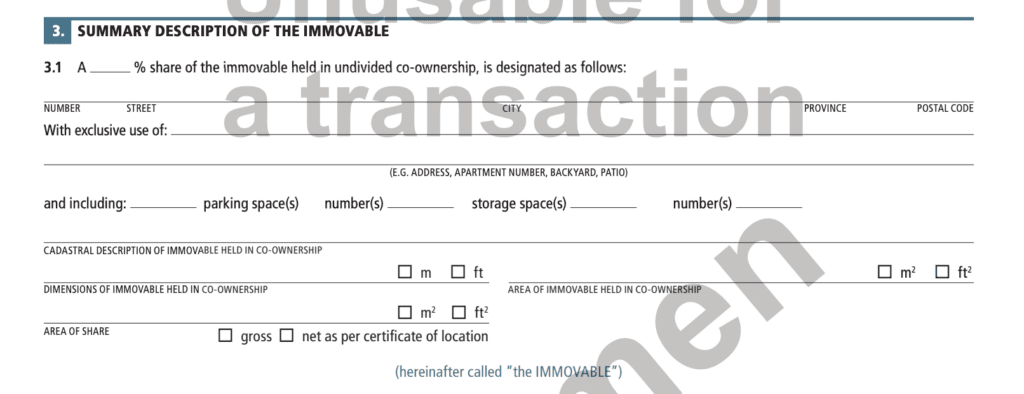

Identification of the undivided share

Unlike a divided condominium where each unit is distinct, an undivided property implies that buyers hold an undivided share of the entire property. The purchase agreement must clearly specify the undivided share that the buyer is acquiring. This can be expressed as a percentage or fraction, depending on the co-ownership agreement.

Divided and undivided co-ownership, how to differentiate between them?

Description of the undivided property

La promesse d’achat doit contenir une description précise de la propriété indivise, indiquant la part spécifique que l’acheteur a l’intention d’acquérir, ainsi que l’adresse complète de la propriété. Cette description peut inclure des informations sur la superficie totale de la propriété et la localisation de la part indivise dans l’ensemble.

Rules and obligations of co-ownership

The rules and obligations governing co-ownership must be clearly defined in the purchase agreement. These rules are typically outlined in a co-ownership agreement, specifying the rights and responsibilities of each co-owner. The buyer should be informed of these provisions before committing to the transaction.

Access and Use of Common Areas

Undivided properties may have common areas, such as outdoor spaces or shared facilities. The purchase agreement must detail the buyer’s rights of access and use of common areas, taking into account their undivided share.

Specific financing conditions

The financing terms must be adjusted according to the nature of the undivided property. For properties held in undivided co-ownership, it is important to note that the mortgage must be obtained with the same bank for all co-owners. Generally, only BNC and Desjardins banks offer this type of financing for properties held in undivided co-ownership.

Pre-purchase inspection

Just like in the case of a divided condominium, the buyer has the right to conduct a pre-purchase inspection of the undivided property. This helps to identify any potential issues or defects and prevents surprises after the purchase.

Did you know that it is possible to cancel a purchase offer after the inspection?

Seller's Declarations and Obligations

The property is not subject to a preemptive right in favor of a third party, excluding other co-owners. This clause assures the buyer that the seller has not granted a preemptive right to a third party over the property, except for other co-owners.

Amount of Down Payment

The down payment must be specified in the purchase agreement and is typically 20% for an undivided co-ownership. This sum represents the buyer’s initial commitment and clarifies the financial expectations from the outset of the transaction.

The promise to purchase for an undivided co-ownership requires particular attention to details specific to this type of property. By fully understanding the nuances of this real estate, and incorporating these elements into the purchase agreement, the involved parties can ensure a smooth transaction that complies with applicable laws and regulations. It is highly recommended to consult with a real estate legal professional to ensure that all legal and contractual aspects are properly addressed.

For more details, refer to our article on the Purchase Agreement

Explore other real estate information

The Promise to Purchase for an undivided co-ownership

The Promise to Purchase for an undivided co-ownership The Promise to Purchase an undivided property in Quebec differs significantly from that of a divided condominium.

Tranquilli-T: A program offered by RE/MAX real estate brokers

Tranquilli-T – Key Points The Tranquilli-T Program by RE/MAX We understand that buying or selling real estate is a significant step in your life. Our

The conversion of a duplex or triplex (plex) into a cottage (single-family house): a project gaining popularity

Converting a plex into a single-family house – Neighborhoods in Montreal A unique real estate project One of the real estate assets that particularly catches