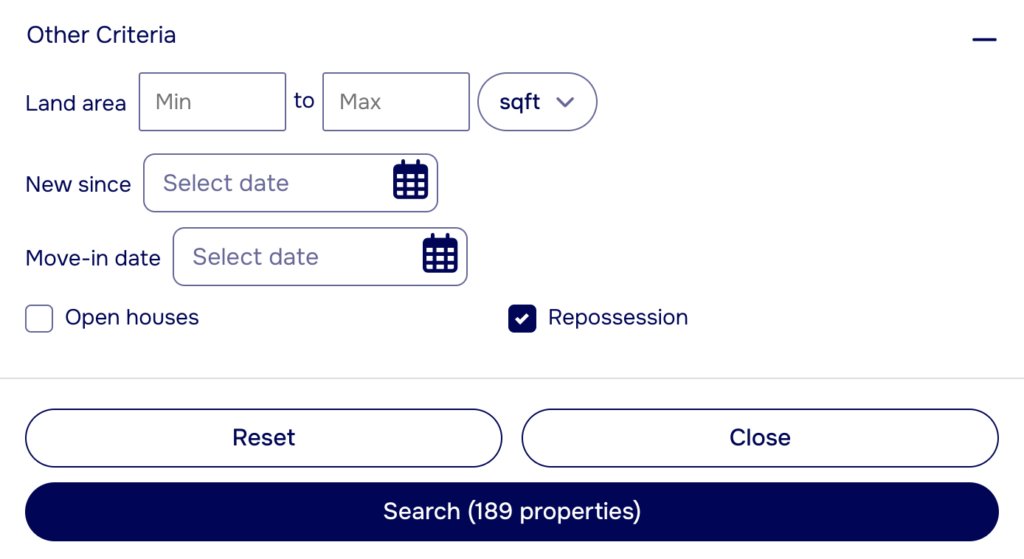

If you’re looking for your new home, chances are you’ve already noticed the Repossession search criterion on Centris, which allows you to filter the properties involved in this type of procedure. To help you better understand this type of sale, our Montreal real estate team presents the main advantages and disadvantages associated of a financial repossession.

What is a financial repossession?

Repossession of finance, also known as mortgage foreclosure, is a legal process whereby a financial institution repossesses a property when the owner has failed to meet his or her payment obligations. In other words, if a homeowner stops repaying his or her mortgage for an extended period, the lender can take legal steps to repossess the property and put it up for sale to recover the sums owed.

However, this procedure is relatively complex and costly, often prompting lenders to offer homeowners a second chance. In most cases, the financial institution begins by sending a notice of default, followed by a letter of formal notice, before handing the file over to its foreclosure department.

When the property is seized, the financial institution calls in professionals to assess its market value. Once this step has been completed, the house is put up for sale on the market, usually through a real estate broker mandated by the lender.

The advantages of a financial repossession

Buying at a lower price

Since lenders generally wish to sell this type of property as quickly as possible, they are often marketed at a lower price than comparable properties. According to Centris, finance repossessions typically sell for 10% to 25% below market value.

Less competition

Not all buyers are attracted to this type of property. Indeed, finance repossessions sometimes require renovation work, which can dissuade some buyers who are looking for a turnkey home, ready to move into without repairs. This context reduces competition between buyers, which can be very advantageous in today’s real estate market.

Opportunity for value appreciation

Financial repossessions often require renovation work, providing an excellent opportunity to significantly increase their value. By carrying out well-targeted renovations, these properties can see their price rise significantly, offering attractive appreciation potential for discerning buyers. What’s more, for those with renovation skills who wish to carry out the work themselves, these properties represent an ideal opportunity to maximize their return on investment while reducing renovation costs.

Accelerated procedure

The disadvantages of a financial repossession

Buying without legal warranty

Since financial institutions do not have complete information on the property’s actual condition or maintenance history, finance repossessions are sold without a legal warranty. As a result, the buyer assumes full responsibility for the property’s condition, and has no recourse against the seller in the event of a hidden defect. In short, this type of transaction is carried out at the buyer‘s own risk.

Uncertainty about the state of the property

Some finance repossessions may show damage that occurred when the previous owners left, or require major repairs. What’s more, since creditors don’t have access to the property’s complete history, it’s crucial to carry out a thorough pre-purchase inspection. This step enables us to better assess the property’s actual condition and identify any work that needs to be carried out, thereby reducing the risks for the buyer.

Observing a lack of available information

Another major challenge when buying finance repossessions is the lack of information available. As creditors are not responsible for maintaining the property, it is often difficult for buyers to obtain details of the home’s history, repairs carried out or recurring problems. This lack of information can lead to uncertainty and increased risk for the buyer, who may end up having to invest much more than expected to bring the property back into good condition.

All in all, buying a finance repossession can offer considerable advantages, such as lower prices, less competition and the chance to make a profitable investment through renovations. However, it’s essential to weigh these advantages against the associated risks, such as uncertainty about the property’s condition and the lack of legal guarantees. Before embarking on such a transaction, it’s vital to fully understand the implications and take all the necessary precautions, including calling in experts for a thorough inspection. Being accompanied by an experienced real estate broker will enable you to benefit from sound advice and determine whether a financial repossession represents a wise investment for you.