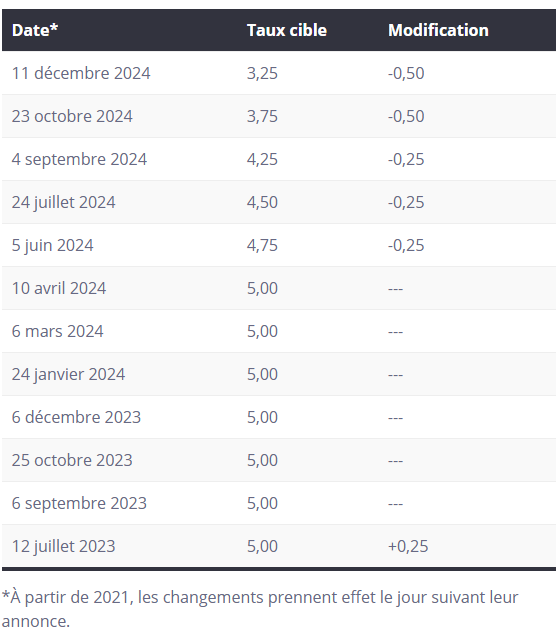

Montreal, December 11, 2024 – Today, the Bank of Canada announced a new reduction in its key interest rate. It now stands at 3.25%. This 50-point reduction is intended to reduce the fight against inflation and move closer to the 2% target.

A further cut in the key interest rate to curb inflation

Some economists attribute this new drop to the recent rise in the unemployment rate, according to Statistics Canada data. In November, the unemployment rate rose from 6.5% to 6.8%, prompting the Bank of Canada to adjust its monetary policy.

Impact on the Quebec real estate market

Source: Bank of Canada

This further reduction will have an impact on the economy as a whole and on the Quebec real estate market. Lowering the key interest rate to 3.25% could influence mortgage rates and bring them down. This would be beneficial for buyers, making home ownership easier.

For sellers, the drop in the key interest rate represents an opportunity to sell their properties more quickly. Indeed, a greater number of potential buyers, now able to obtain mortgage loans, could speed up the process of selling their property.

In short, this reduction will benefit both buyers and sellers. According to some forecasters, further adjustments are to be expected in the coming months, with the aim of further reducing inflationary pressures. We invite you to follow the articles of our Montreal real estate brokers to keep up to date with the latest real estate news on this subject.

Sources :

Radio-Canada. https://ici.radio-canada.ca/nouvelle/2125571/prevision-banque-canada-reduire-taux-directeur-

Statistics Canada. https://www150.statcan.gc.ca/n1/daily-quotidien/241206/mc-a001-eng.htm