The policy interest rate remains stable at 5%

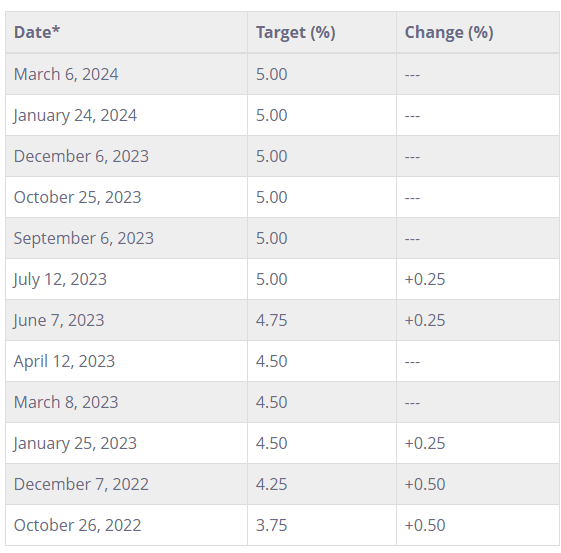

Montreal, March 6, 2024 – Today, the Bank of Canada announced the maintenance of its policy interest rate at 5%, a long-awaited stability that brings a sense of confidence to the real estate sector.

Impact on the Montreal Real Estate Market

In early 2023, in response to an increase in the key rate reaching between 4.5% to 5%, the real estate market experienced a significant slowdown. This surge represented a considerable leap from the key rate, which varied between 0.25% and 1.75% during the pandemic (2020 to 2022), affecting the mortgage rates offered by major banks. In this economic context, many buyers abandoned their purchase plans in early 2023, hoping for a potential decrease in rates.

Source : Bank of Canada

Following the maintenance of the key rate at 5% in the last five announcements, several buyers have resumed their purchasing projects. Notably, the announcement in January 2024 of the key rate remaining at 5% led to a resurgence in the real estate market, as observed by our real estate brokers in Montreal.

Favorable Financing Conditions for Property Acquisition

With an unchanged key rate, borrowers benefit from favorable financing conditions. Mortgage rates from major banks are expected to remain attractive, encouraging Canadians to invest in real estate. Buyers actively seeking a new home currently enjoy a less competitive market due to the absence of other buyers.

If you are a buyer looking for your next acquisition, we invite you to read the following article: Is it the Right Time to Buy a Property?

Anticipated Key Rate Decrease in 2024

According to many economists, it looks like there might be a decrease in interest rates by the end of 2024, as they foresee the possible conclusion of rate hikes. If this happens, it might motivate a lot of buyers to kick-start their real estate plans, making the competition in the market more intense. We’ll keep a close eye on the Bank of Canada’s next announcement on April 10.

In conclusion, the decision of the Bank of Canada to maintain the key rate at 5% offers a positive outlook for the Montreal real estate market. Economic stability and favorable financing conditions contribute to creating a conducive environment for buyers.

Sources :

Policy interest rate | Bank of Canada

https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

Raise in key interest rate: its impact on mortgages and the real estate market | Yanick Sarrazin

https://yanicksarrazin.com/en/immobilier/news/raise-in-key-interest-rate-its-impact-on-mortgages-and-the-real-estate-market/

Mortgages : understanding them better for a real estate purchase | Yanick Sarrazin

https://yanicksarrazin.com/en/immobilier/buyer-information/mortgages-understanding-them-better-for-a-real-estate-purchase-2/

Real estate brokers Montreal | Yanick Sarrazin

https://yanicksarrazin.com/en/montreal-real-estate-broker/

Is it the right time to buy a property | Yanick Sarrazin

https://yanicksarrazin.com/en/immobilier/buyer-information/is-it-the-right-time-to-buy-a-property/

Interest rates may have peaked – is it time to jump into the housing market? | Yanick Sarrazin

https://globalnews.ca/news/10251001/interest-rate-hold-spring-housing-market/

Read more real estate information

Montreal’s culinary scene honored by Michelin Guide

Montreal, May 24, 2025 – Last week, the Michelin Guide unveiled its long-awaited list of the best restaurants in Quebec. Our team of real estate brokers is delighted to help you discover the Montreal establishments that made the cut. Montreal’s rich culinary scene The Michelin Guide awards several distinctions, including the famous stars for culinary excellence. It also awards Bibs Gourmands to restaurants offering high-quality, affordable cuisine, and Étoiles Vertes to establishments committed to sustainable

Co-ownership: advantages and disadvantages

In Montreal – whether in the Plateau Mont-Royal, Rosemont La Petite-Patrie or Villeray areas – you’ll find a large number of properties available in divided or undivided co-ownership. This type of housing appeals to many buyers because of its many advantages, although it can also present certain disadvantages, depending on individual needs and expectations. To help you make an informed decision, our team of Montreal real estate brokers presents the main advantages and disadvantages of

Matcha lovers: Our favorite Montreal addresses

Matcha has been all the rage in recent years. Indeed, more and more people are switching from their morning coffee to this green beverage with its many benefits. As part of Japan Week, our team of real estate brokers in Montreal reveal their top addresses for tasting the best matchas in the metropolis. Matcha | Plateau-Mont-Royal Located on the Plateau Mont-Royal, the charming Matcha tea room invites you to discover an authentic experience. This café-boutique

Real Estate Trends: An Overview of the First Quarter of 2024

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have meticulously scrutinized the emerging trends in the

Tranquilli-T: A program offered by RE/MAX real estate brokers

Tranquilli-T – Key Points The Tranquilli-T Program by RE/MAX We understand that buying or selling real estate is a significant step in your life. Our

The conversion of a duplex or triplex (plex) into a cottage (single-family house): a project gaining popularity

Converting a plex into a single-family house – Neighborhoods in Montreal A unique real estate project One of the real estate assets that particularly catches