Interest Rate Decrease to 4.75%: A Breath of Hope in the Montreal Real Estate Market

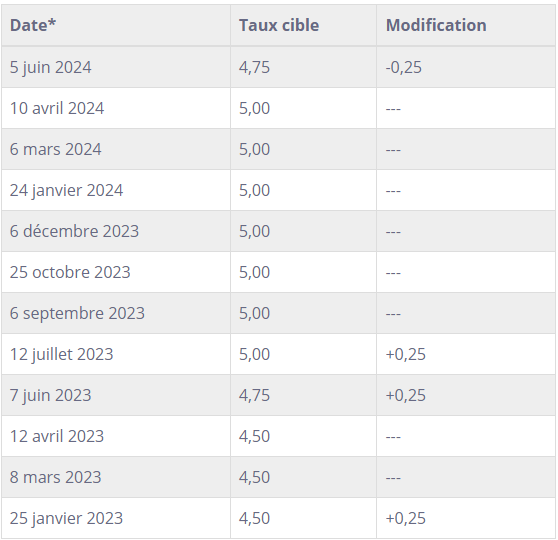

Montreal, June 6, 2024 – Yesterday, the Bank of Canada announced the reduction of its key interest rate to 4.75%, a verdict that suggests a renewed sense of hope for many buyers eyeing the Montreal market. This long-awaited decrease brings significant relief to potential buyers and energizes the real estate sector in Montreal.

Impact on the Montreal Real Estate Market

According to economists, this 25-point decrease aims to alleviate inflationary pressures and support the Canadian economy, which has shown signs of slowing down. The Bank of Canada has also hinted at potential further rate cuts later this year, which could further energize the real estate market.

Source : Banque du Canada

For buyers, this rate reduction potentially means lower borrowing costs, which could make purchasing a property more accessible. On the sellers’ side, a decrease in interest rates makes the market favorable for selling their property.

In essence, this decrease in the key interest rate offers opportunities to both buyers and sellers, while reflecting the efforts of the Bank of Canada to support the national economy.

Sources :

La Banque du Canada diminue son taux directeur de 25 points de base, à 4,75 %

https://www.banqueducanada.ca/grandes-fonchttps://ici.radio-canada.ca/nouvelle/2078260/taux-directeur-banque-canada-juin-2024tions/politique-monetaire/taux-directeur/

Plusieurs banques annoncent qu’elles baissent leurs taux d’intérêt préférentiels

https://www.lapresse.ca/affaires/2024-06-05/baisse-du-taux-directeur/plusieurs-banques-annoncent-qu-elles-baissent-leurs-taux-d-interet-preferentiels.php

Baisse du taux directeur: quel impact sur le marché immobilier?

https://www.ledevoir.com/economie/814337/baisse-taux-directeur-quel-impact-marche-immobilier

Check out our real estate information

Real Estate Trends: An Overview of the First Quarter of 2024

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have meticulously scrutinized the emerging trends in the

Tranquilli-T: A program offered by RE/MAX real estate brokers

Tranquilli-T – Key Points The Tranquilli-T Program by RE/MAX We understand that buying or selling real estate is a significant step in your life. Our

The conversion of a duplex or triplex (plex) into a cottage (single-family house): a project gaining popularity

Converting a plex into a single-family house – Neighborhoods in Montreal A unique real estate project One of the real estate assets that particularly catches