Drop in Key Interest Rate to 4.50%: A Second Boost for the Montreal Real Estate Market

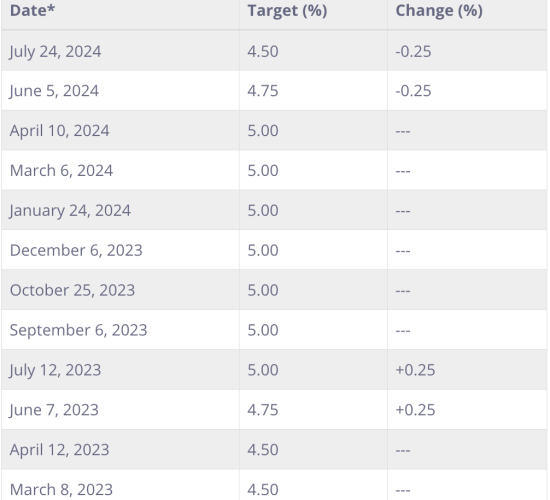

Montreal, July 24, 2024 – As anticipated, the Bank of Canada announced today a second reduction of its key interest rate, bringing it down to 4.50%. This 25 basis points decrease aims to reduce inflationary pressures, allowing inflation to approach its target of 2% in the coming months.

Impact on the Market

This rate cut is a breath of fresh air for many buyers who have been waiting for an opportunity to enter the market. With reduced borrowing costs and more accessible mortgage qualification thresholds, real estate activity is expected to increase significantly.

For sellers, a decrease in interest rates makes the market favorable for selling their property. With a larger number of potential buyers able to qualify for mortgages, the increased demand can lead to quicker sales.

Also read : Mortgages : understanding them better for a real estate purchase

Source : Banque du Canada

Real Estate Trends: An Overview of the First Quarter of 2024

Real Estate Trends – Key Points As the city slowly emerges from winter, our real estate brokers have meticulously scrutinized the emerging trends in the

Tranquilli-T: A program offered by RE/MAX real estate brokers

Tranquilli-T – Key Points The Tranquilli-T Program by RE/MAX We understand that buying or selling real estate is a significant step in your life. Our

The conversion of a duplex or triplex (plex) into a cottage (single-family house): a project gaining popularity

Converting a plex into a single-family house – Neighborhoods in Montreal A unique real estate project One of the real estate assets that particularly catches