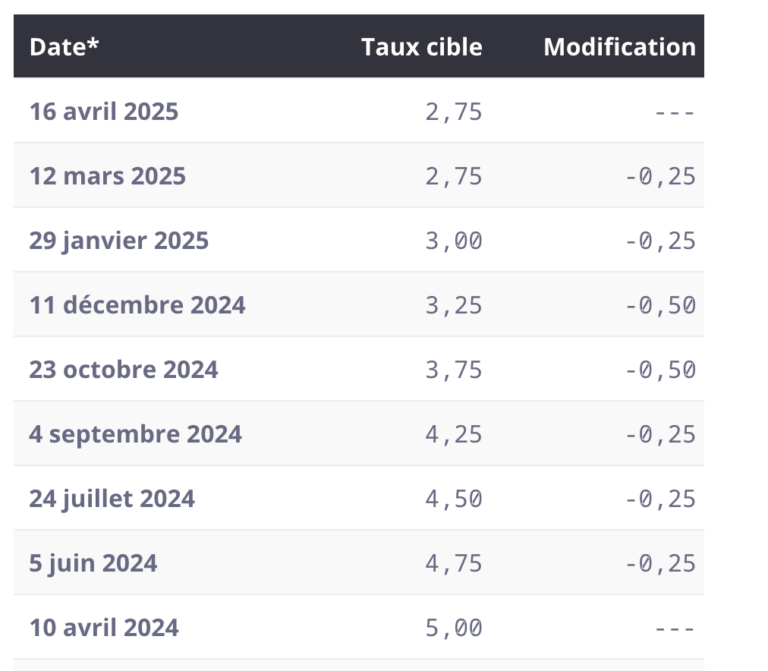

Montreal, April 16, 2025 – The Bank of Canada has decided to maintain its key rate at 2.75%. This stability is explained by economists’ desire to await developments in the ongoing trade war between Canada and the United States before making any adjustments.

Source : Bank of Canada

Maintaining this rate continues to have a positive impact on the Canadian economy. In particular, it encourages consumer spending, since lower interest rates reduce borrowing costs for financial institutions, which can then offer advantageous terms to their customers. This favorable environment could encourage more buyers to realize their real estate projects.

While this decision is particularly favorable for buyers, it also has advantages for sellers. Increased demand on the real estate market, supported by easier access to credit, increases the likelihood of selling quickly at a competitive price. In short, the improvement in household purchasing power could breathe new life into the real estate market as a whole.

To better understand the impact of the 2.75% key interest rate on your real estate projects, don’t hesitate to contact our real estate brokers in Montreal.

Sources

Bank of Canada. https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/?theme_mode=light&_gl=1*1v19lw8*_ga*MTQ5NjYzMjA2Ni4xNzQ0ODEzNzU2*_ga_D0WRRH3RZH*MTc0NDgyODMwMC4yLjAuMTc0NDgyODMwMC42MC4wLjA.

Bank of Canada.

https://www.bankofcanada.ca/2023/12/how-higher-interest-rates-affect-inflation/?theme_mode=light&_gl=1*112lhw*_ga*MTQ5NjYzMjA2Ni4xNzQ0ODEzNzU2*_ga_D0WRRH3RZH*MTc0NDgyODMwMC4yLjEuMTc0NDgyODM1OC4yLjAuMA.

La Presse. https://www.lapresse.ca/affaires/economie/2025-04-16/banque-du-canada/le-taux-directeur-reste-inchange-a-2-75.php