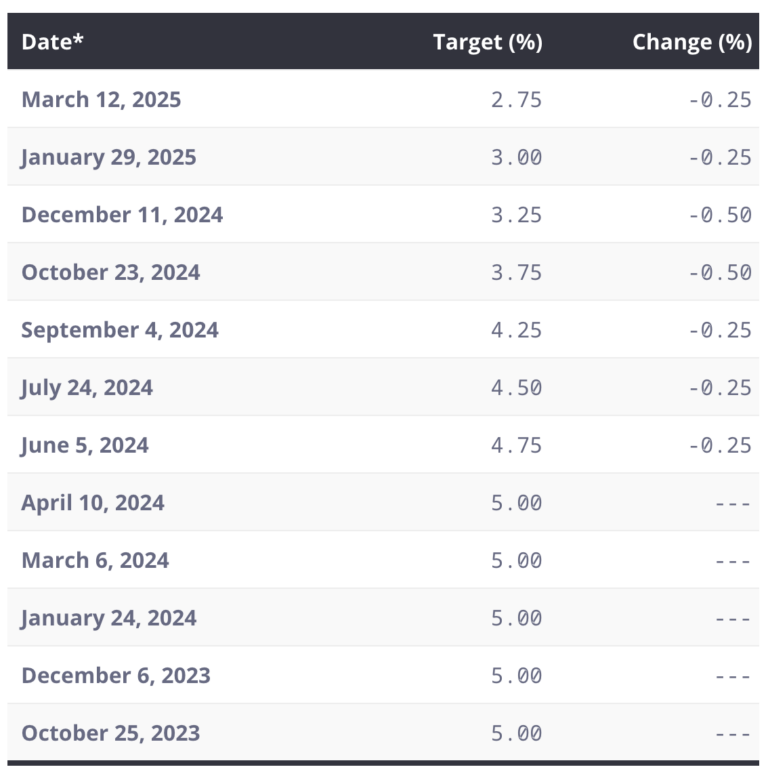

Montreal, March 12, 2025 – The Bank of Canada has announced a further 0.25% reduction in its key policy rate to 2.75%. This marks the seventh consecutive reduction since June 5, 2024.

Source : Bank of Canada

Further decline in response to trade tensions between Canada and the United States

This decision comes in the context of growing trade tensions between Canada and the United States. Some economists predict that future tariffs imposed by the U.S. President, along with Canadian counter-tariffs, could put further pressure on inflation in Canada. This measure is largely intended to protect the Canadian economy from the impact of U.S. tariffs.

An opportunity for buyers and sellers!

Although some economists predict that this economic uncertainty could put off investors, it represents a real opportunity for buyers. Indeed, a reduction in the key interest rate generally leads to a drop in mortgage rates, making monthly payments more affordable and facilitating the repayment of home loans.

What’s more, this situation can also be advantageous for sellers, since with a greater number of buyers, properties should sell faster.