The Promise to Purchase - Key Information

What constitutes a Promise to Purchase?

The Promise to Purchase is addressed by the potential buyer of the real estate, to the seller of this one, following a conclusive visit which gives him desire to make the acquisition.

- The Promise to Purchase is one of the important documents in a real estate transaction that serves to protect the buyer. In other words, the Promise to Purchase is a pre-contract since it does not constitute the official contract between the seller and the buyer. In fact, the deed of sale is the official and irrevocable document binding the two parties in the real estate transaction.

However, the Promise to Purchase is nonetheless of great importance since it constitutes a formal commitment between the seller and the buyer. In fact, the seller undertakes to write down everything he knows about his property, while the buyer ensures, for example, that he has the financial means to purchase the property.

It is also in this document that you will indicate to the seller that you are inclined to purchase their property, as well as the conditions under which you wish to do so.

The different parts of a Promise to Purchase

The clearer and more detailed the Promise to Purchase, the less open to interpretation. Some of the information it should contain includes:

For information purposes, we used a Promise to Purchase for a mainly residential building of less than 5 units excluding condominiums.

1. Identification of the parties

In a residential property transaction, both parties (buyers and sellers) must know their identities. This is the first section of the Promise to Purchase. On the left is the identification section for buyers and on the right for sellers.

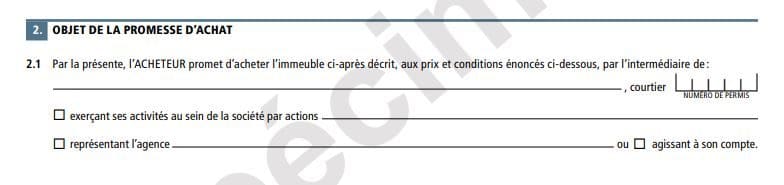

2. Purpose of the Promise to Purchase

In this section, we find the identity of the real estate broker representing the buyer, as well as his license number and the real estate agency he works for, if applicable.

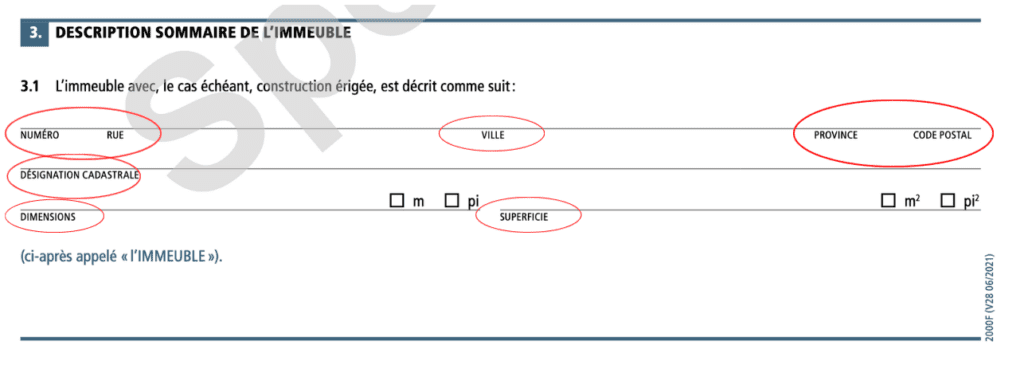

3. Brief description of the building

A description of the property to be purchased, including the complete address, cadastral designation, dimensions and area.

4. Price and deposit

This is the section where you will find the price conditions. This is where you indicate the price you think is fair to purchase the property you want. Your offer can be lower, equal or higher than the seller’s asking price. You must also indicate the amount of the deposit if applicable.

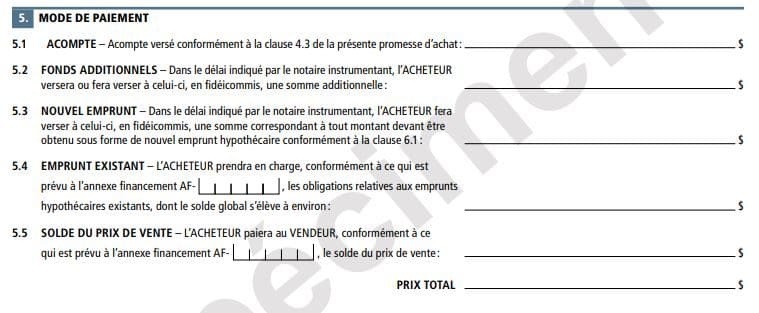

5. Method of payment

You must now enter the details of your payment method. If you left a down payment in section 4.3, you will need to re-enter it in section 5.1.

The total of the amount indicated in sections 5.1 (if applicable) and 5.2 represents your down payment.

6. New mortgage loan

If you are proceeding with a mortgage loan, you must indicate the details in this section: the amount, the conditions and the deadline for obtaining your financing.

We invite you to understand clause 6.3.

7. Declarations and obligations of the buyer

The seventh part of the Promise to Purchase deals with the declaration and obligations of the buyer. Also, if the buyer is related to the agency or broker representing him, this is where it should be reported.

8. Inspection by a person designated by the buyer

It is in clause 8 that you must indicate if you wish to have the building or property in question inspected. Be aware that there is a possibility to cancel an offer to purchase following the inspection.

9. Buyer's review of documents

When you are accompanied by a real estate broker, he/she can send you all the documents related to the sale of the property available on the Centris platform. When you write your promise to purchase, if all the documents you wanted to see were available online and you are satisfied, there is no need to fill out this clause.

10. Declarations and obligations of the seller

The tenth section deals with the obligations of the seller to the buyer in the transaction.

11. Declarations and obligations common to the buyer and seller

The eleventh section refers to obligations that are common to both buyers and sellers, particularly in relation to the date of the deed, including the day the buyer will take ownership of the property, the date of occupancy of the premises, apportionments, payments and inclusions and exclusions of property.

Do not hesitate to ask your real estate broker any questions you may have before signing the Promise to Purchase. Make sure that all the conditions are included, as well as the possession and notary dates.

12. Other statements and conditions

This is where you can indicate any general conditions that you would like to add to your Promise to Purchase.

Common examples would be, a notice of non-renewal of a tenant’s lease while the property is rented, repair of a non-functional included item, etc.

13. Annexes

When there are schedules to be attached to the promise to purchase, you must indicate them here.

For example, when you are financing the purchase of your property, you must complete the financing annex.

14. Conditions of acceptance

This is where you indicate to the seller the time frame you are allowing him to respond to your offer.

We invite you to respect the deadlines requested by the seller if necessary.

15. Interpretation

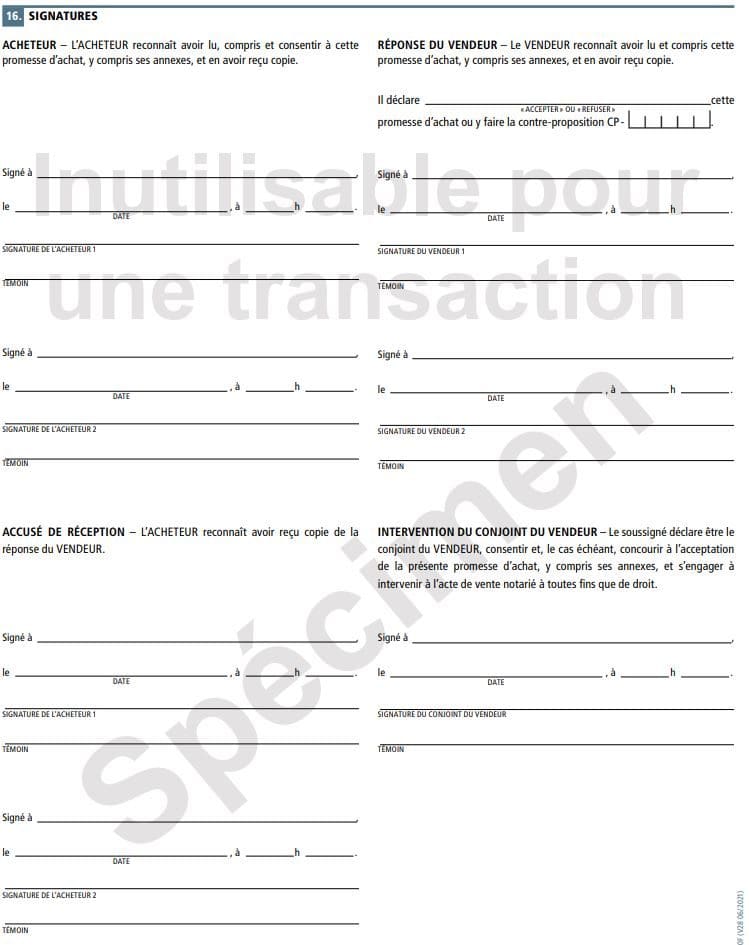

16.Signatures

When you have gone through your promise to purchase with your real estate broker, and you have included all your conditions, this is where you should sign!

You will also find a section for the seller’s response. He will indicate whether he accepts or refuses the promise to purchase.

What should the seller do after receiving the promises to purchase?

Once the Promise to Purchase is handed over to the seller, 3 options are available to him:

Accepted offer

Upon acceptance of your offer, you must fulfill the conditions set out in the Promise to Purchase in a timely manner. The most common conditions are to obtain the necessary financing and the inspection of the property by a recognized expert.

Refused offer

Even if your offer meets all of the seller’s conditions, the seller can refuse your Promise to Purchase. If you are interested in the property, there is nothing to stop you from proposing a new Promise to Purchase to the seller.

Counter proposal

Here, the seller refuses your offer, but may accept it under certain conditions. This could be a different price, or elements that he wants to exclude or modify. In turn, you can accept, refuse or respond with a counter-offer.

It is also in the Promise to Purchase that the acceptance period that you require from the seller in the event that he accepts your offer will appear. In some cases, the seller may ask for a deadline to be met.

Note that if your Promise to Purchase is accepted by the seller, it becomes an irrevocable contract that obliges you to purchase the property for which you have made an offer.

What if the seller receives multiple Promises to Purchase?

In the event that the seller receives multiple bids, the broker representing the buyers must present all bids received within a reasonable period of time following their receipt, without preference (e.g., the broker may not present the highest bids first, without considering their order of receipt).

The listing broker (i.e. the seller’s broker) must then present to his client all the Promises to Purchase received and advise him so that the latter can make the most judicious decision possible according to his needs and expectations and/or make a counter-proposal to one of the potential buyers.

Can I withdraw from a Promise to Purchase?

If all the conditions of your Promise to Purchae are met, your commitment to the seller is irrevocable. However, if one of the conditions mentioned in your Promise to Purchase cannot be fulfilled (for example, financing), this will render your document null and void.

Different types of Promises to Purchase

It is also important to note that there are different formats for the Promise to Purchase, depending on the type of property you wish to purchase. In fact, these differences in content are intended to accentuate the particularities of the types of housing that exist. It is therefore important that you ensure that your real estate broker sends you the right document when you wish to make an offer to purchase.

Do you have any questions? Contact one of our real estate brokers

See more real estate news

Drop in Key Interest Rate to 3.75%: An Opportunity for Buyers and Sellers!

Table des matières Montreal, October 23, 2024 – Today, the Bank of Canada announced a substantial cut in its key interest rate to 3.75%. This

Provident Fund, Maintenance Booklet and Inspector Certification for the Real Estate Sector: Bill 16

Table des matières On December 5, 2019, the provincial government adopted a major reform of the Régie du logement, marked by Bill 16. This initiative

Mortgage reforms: towards easier access to home ownership for Canadians

Mortgage reforms – Important points As of December 15, Canadians will find it easier to buy a home, thanks to two new reforms implemented by